Wisdom in Wealth Creation for Employees

We all have 24 hours a day. We have limits. So, when we are just employees, how can we grow our wealth?

- You need to increase your rate per hour – why would one be paid RM2,400 a month while another person gets RM4,000? So, you have to work towards increasing your worth. Your worth does not increase with your qualification – but with what you can offer to your employer. It’s a simple equation – if you bring RM20,000 to the business, and the company’s margin is 30% – then your contribution is RM6,000 profit. Would you expect your boss to pay you RM10,000? If you were the boss, what would you say?

- You have to make your money work – so you have to invest. Investing means putting your money into something that is growing. For instance, when I buy shares of a good listed company that pays a decent dividend and brings capital growth, both the dividend return and capital appreciation can be my return. It is easy to achieve a 10% return with good knowledge and discipline. Remember, if you have only RM100K in funds – a 10% return is a piece of cake. If you have RM100m in funds – then a 10% return can be more challenging.

2 Scenarios

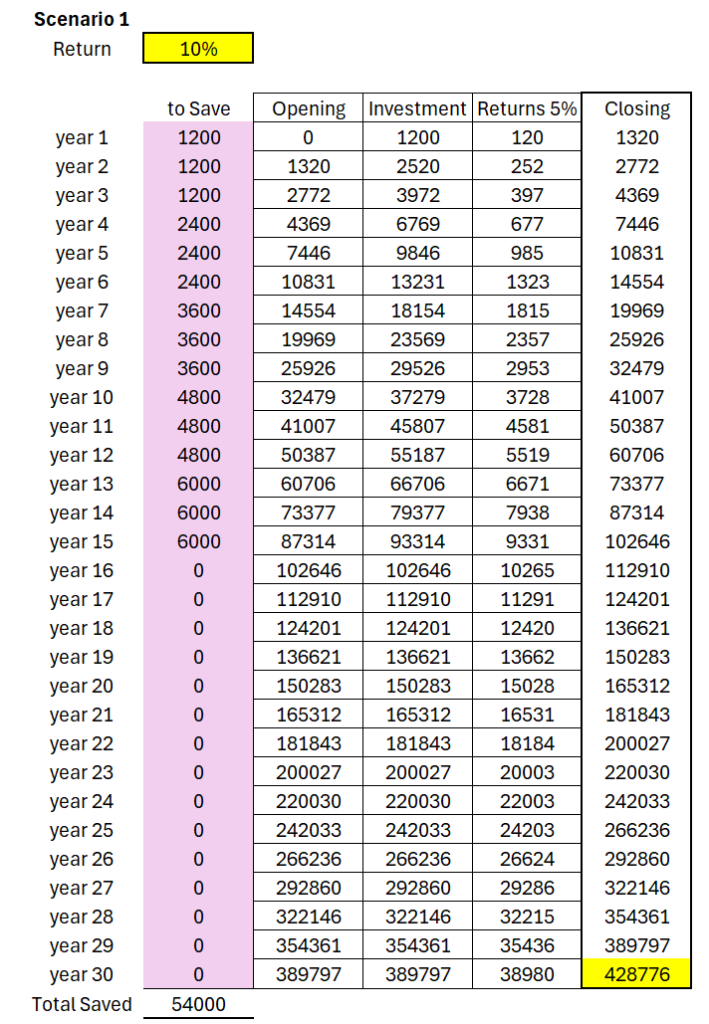

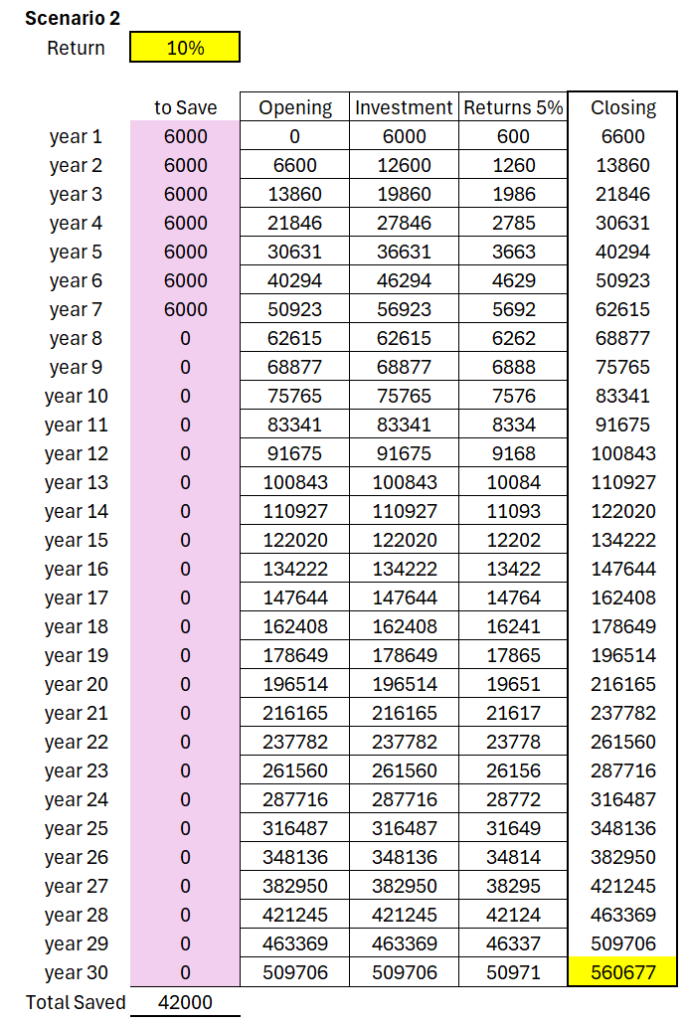

As you can refer above, I am presenting two scenarios. Both require constant investment every year to a certain stage when you can stop. Both use a 10% return rate.

In the first scenario, you start with RM100 saving a month and increase it to RM200 per month in year 4, RM300 per month in year 7, RM400 per month in year 10, and finally to RM500 per month in year 13. You will stop investing at the end of Year 15. Your income will grow as you age, so you can set aside more for investment. You can see your investment of RM54,000 will bring you a nearly 8 times return over a 30-year period.

In the second scenario, you start with RM500 saving a month and keep the same momentum of RM500 for a total of 7 years. You will see a total fund of RM560,000 at the end of 30 years.

Observations

Observation You will notice in scenario one, you pumped in more, RM54,000, as opposed to RM42,000, but you also see the second scenario has a greater fund size in the end.

So, the earlier you start – the faster you gain. Investments will grow exponentially – but at a later stage. Look at scenario 2. From Year 7 to Year 8, the increase is only RM6,888, but from Year 29 to Year 30, it increased by RM50,971. So, investing requires discipline – the discipline to keep investing, the discipline not to touch your investment fund, and the discipline not to risk your investment in something ridiculous and lose all your hard-earned savings.

Whatever it is, starting with RM100 per month or RM500 per month – they are not unachievable. The key is to start.

Wish to have RM1million? Just double the amount. Not that hard isn’t it?

I have included the Excel sheet if you want to play with it by changing the numbers. Enjoy, and be wise.

By Low Chin Ann