ACCA Careers in Malaysia

First step into your career

We all know that studying is not just about being passionate or interested with the subject but it is about the very “bread and butter” issue. Where am I heading to with my ACCA qualification? Most of our students would select either “Practice” route or “Commercial route.

Practice Route

-

- You will seek an employment with public accounting firm. You probably have heard by now terms like “the Big 4 firms” (ie. Deloitte, EY, KPMG and PWC) or medium firms like Baker Tilly, BDO, Crowe Howarth, YYC and so on. Applying with them means you are heading into areas like auditing and assurance or tax as your key specialisation for a start.

- The larger firms usually will categorise their lines of services into

- Assurance & Risks – these are most commonly referred by many as “Audit” job. Well the scope will obviously be greater, but yes, most of us begin here, applying mostly the skills you acquired from paper AA and you are most probably be asked to carry out vouching and inspection of documents, verify transactions as part of evidence gathering needed to support and expression of an audit opinion over financial statements prepared by the audit clients. As you progressed career in this field, you could be an audit manager or branch out into internal control experts, risk consultant, risk auditor, internal auditor and so on.

- Tax – this is the 2nd most popular area besides Assurance. In this field, your job scope is more predictable, your time requirement is too more stable, definitely without those travelling here and there that is expected in Assurance function. So if you do not favor travelling around, Tax is perhaps a better option for you. At the beginning, you will be assigned to less complex areas of dealing with compliance (e.g submission of various return forms, simple tax computations). As your experience grows, you will be allowed to deal with more complex issues – and when we say complex issues in taxation – you can really a long list. You can be a specialist in Transfer Pricing, International Taxes, Indirect Taxes, Tax Audit & Investigation Support, Tax litigation, Business and Corporate Tax Planning and so on.

- Consulting / Advisory – most sizeable public accounting firms (esp when you are in the Big 4) will have an extension to this section of business. The term consulting and advisory by itself can be too generalised as the disciplines involved can be vast and wide. You may think about “Emerging Technologies & Data Analytics”, “ERP consultant like those involved with SAP or Oracles”, “Business Transformation”, Perhaps some of you start to recall a bit of those areas learnt in ACCA paper SBL.

Commercial Route

-

- When you decided not to join a public practice, then you are most probably going into a “commercial route” – that is to take on a job offered by those private companies or listed companies. Think about titles like “Accounts Executive”, “Accountant”, “Accounts Manager”, “Chief Financial Officer (CFO)” “Finance manager” and so on. These are obviously works more relevant to what you studied in ACCA. Be prepared that you may have to undertake various roles from highly specialised (eg. you are just employed to deal with Accounts Payable and Accounts Receivable functions) or highly diversified (e.g you are in charge of many tasks placed under the accounting and finance functions of the company. Think about preparing financial reports, consolidations of financial statements, credit control, billing, bank reconciliation, accounting documentations, processing of claims.

- When you are employed in commercial route – you will understand better the processes involved in running of a business – however you will only be able to see within the sector or field that you are working with. Therefore, if you choose with work with a manufacturing company – your exposure is purely on manufacturing line whereas if you are working in a healthcare sector, you will never be able to see processes like of a factory.

Other Routes

-

- Of course there are many other options are opened to you being an ACCA.

- You may join “Regulatory bodies” (e.g. joining Inland Revenue, Bank Negara, Securities Commission, Commercial Crime Unit, etc)

- You could always start your own business as an entreprenuer

- You may have passion to serve in those NPO and NGO. Churches have alot of financial matters where they need accountants too. Charities need accountability as well. So all these can be areas where your expertise are needed.

Differences and also Pay Structure?

Let’s be honest here. Most public accounting firms know that they a huge percentage of their staff will leave after 2 to 3 years. They are expecting you to leave, so they are not designing a pay structure that is intended for you to stay for long. Therefore, you can expect “commercial sector” will pay better than the audit practice. However, in commercial sector, they value your experience. Especially in cases where they do not have sufficient accounting experts in the business to offer you the needed training – they hire you to solve their problems and not be their problem. Therefore, they generally pay better. They want you to stay – because they understand how disruptive it can be to their business whenever there is staff turnover.

- Commercial sector may have less fancy titles or progression. Unlike practice (especially in Big firms) where you can climb the corporate leader with definite mindset like after 1 year my next promotion is to be Senior, then you know you can be the assistant manager and manager and so on. In fact some firms even further divided them like calling it Senior 1, Senior 2, and so forth.

- Commercial sector is very predictable load and work scope – you know exactly when it will be the busiest time of the month. For instance, in a public listed company, they may be the busiest in the week when they need to rush their quarterly financial statements for disclosure purpose. Other than that, you are probably expecting a typical 9-5 job. Well definitely you will not hear of those cases like “working 24 hours for the next 3 days” story. However if you are in the audit line – this crazy kind of schedule is definitely part of your norm. Be prepared for it.

- Commercial sector can be a sector for you to “stay on” for long. If you join a commercial company at the age of 28 to be accounts manager, it is fine that you are still the accounts manager at the age of 38. However, if you are the audit manager at the age of 28 and you remain as an audit manager after 10 years – something is wrong. You don’t go into an audit firm to see a 35 year old audit executive, do you?

So Why join Public Practice then?

So why do you join “practice route” after all?

- Stepping stone – many who started in the audit line moved on to the commercial sides when they receive offers (e.g from audit clients) who find them capable.

- Tradition – it is the road most taken by many. It is like the journey that every accounting graduate will go through and you are no different – you like to have a “taste of it”. After all, no experience in life is valueless. Therefore, spending 2 or 3 years in the practice is not a bad choice after all.

- It pays well – well, be careful of this notion though. When you ask around, you will clearly know when you are paid for a RM3,500 job even at entry level, they expect something more than that from you.

- It looks good – you are a professional.

- Public accountants tend to have a portfolio of clients – so you gain very diverse experience – well having said that, please note that in the big firms, you normally specialise and you don’t expect you get to taste everything. Perhaps the smaller ones, Yes. Example – you could be assigned to the “Energy” sector and focused with only “Petronas’ subsidiaries”.

- You really get opportunity to travel – if you are energetic and enjoy this kind of life. Also the travelling means you have another opportunity to save up on travelling allowance, transport allowance, food allowance, outstation allowance which could all add up to your bank savings.

ACCA Approved Employers

ACCA undertakes accreditation of employer’s learning and development policies and systems and those being accredited are called “Approved Employers”. Quoted verbatim from ACCA website

“If you work for an ACCA Approved Employer who holds trainee development approval at Gold or Platinum level, then they may allow you to claim a performance objective exemption. This exemption exists because ACCA has assessed that the level of training and support they provide to you is sufficient to meet the PER. If you qualify for the exemption, it means that you do not need to record the performance objectives in MyExperience and will achieve these through the training you’ll receive with your employer – and you’ll still need to complete a minimum 36 months’ experience.”

Therefore, employed by an ACCA Approved Employer will mean it will be very much easier for you to attain your ACCA membership, without much of the hassle in the recording of your PER. Make sure you ask your employer – if they are approved as Gold or Platinum level.

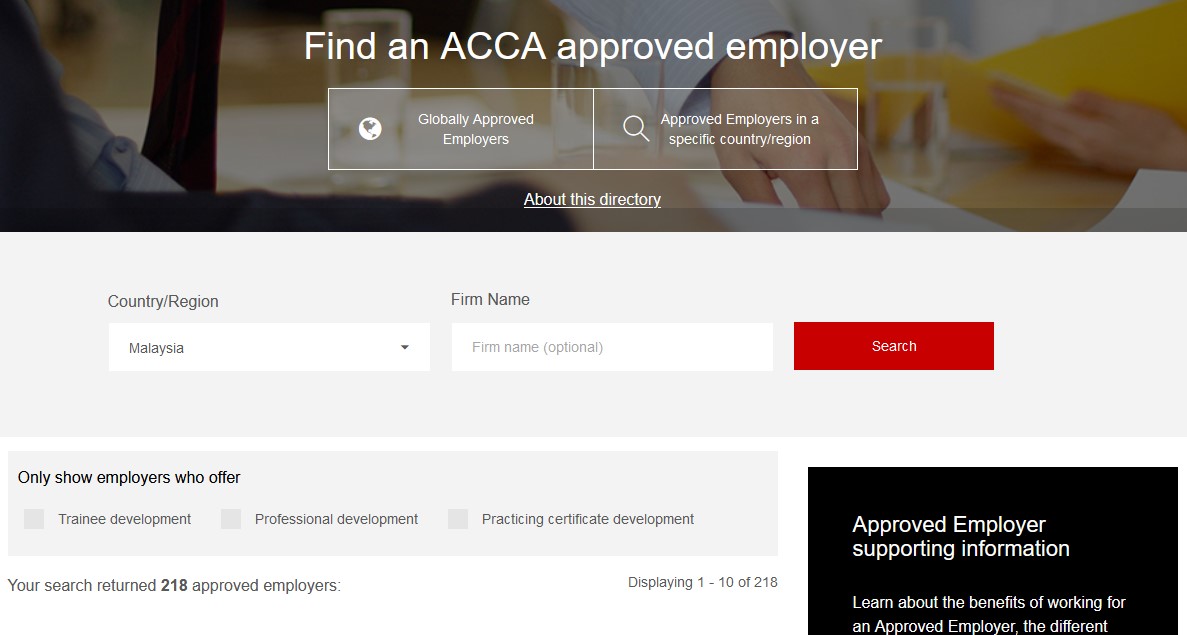

You can click this link to ACCA Approved Employer’s Directory.

A screen shot below showed that there are more than 200 approved employers in Malaysia.

Resume or CV Writing

When you write in to apply for your dream job, the very first point of contact is probably your cover letter and CV / Resume. If you hand in something that is not presentable, most likely you will miss the chance of being short-listed. Therefore, it is very crucial to write a proper Resume. (we do not fuss whether it is called a CV or Resume as they don’t really matter. Do not really need worry about those who tried very hard in a 30 minutes lecture to say that they are different. They don’t)

However, the content your Resume matters. It matters a lot.

Need help to review your resume or career counseling? Talk to us. After all, we are your lecturers.

![]() Questions for Mr Low? Whatsapp him at +60123371090

Questions for Mr Low? Whatsapp him at +60123371090

[Wish to know more about ACCA programme offered by Genesis Origo?]

Other Links

11. How to be a Chartered Accountants in Malaysia.