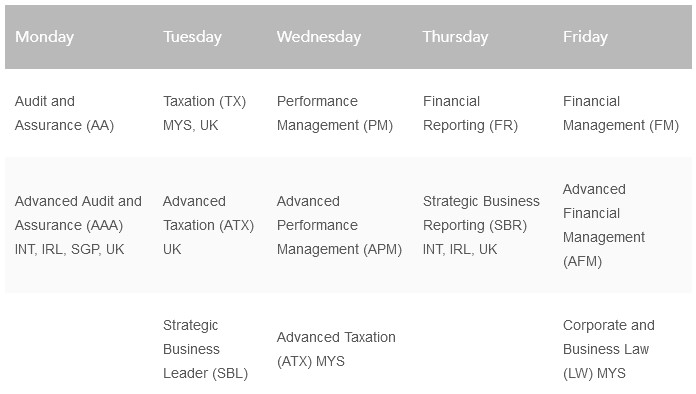

ACCA runs 4 exams a year – in the months of March, June, September and December. At Genesis Origo, we run virtual live classes or face-to-face classes and all our classes are also available for online access at our GO Portal

Quick Glimpse of What Our Satisfied Students Said

This class is amazing! The lecturer clearly explained and give many questions (mock questions) and past year paper answers in order to make you tackle your exam paper in the similar way! I have took ATX in December seating and i’ve passed the paper successfully 🥰🥳❤️ ~Thank you Genesis Origo~

Took ATX course in elsewhere last time, after that switched to Mr Low for ATX course and finally passed it, He can really make the complex syllabus to ease the students through his multiple examples provided during the classes. Great tax lecturer!

It has been a great pleasure to study in Genesis Origo. I signed up for two subjects, ie Advanced Taxation and Advanced Audit and Assurance.The lectures conducted by Mr Low for Advanced Taxation and Mr Yap for Advanced Audit and Assurance are clear and can be easily understood.The notes given are comprehensive as well.I really appreciate Genesis Origo allow its students to access the study videos for a full year as partime students like me may defer exam due to work commitments.Thank you so much Genesis Origo.

Mr Low is hands down the best ACCA Tax law lecturer you will have. He is very knowledgeable on the subject matter and also goes the extra mile for us students to ensure we perform well. Prior to enrolling for TX classes I was unsure which professional options paper to pick however once I had attended his classes it was a no brainer ATX would be one of my option papers. He has the ability to make complex topics simple to comprehend which I feel is extremely important when it comes to a subject like ATX.

Strongly recommended for those who has very weak or no basic in TX(Mys) to sign up for Mr Low's ATX classes. He will provide supplementary videos and notes on the important topics from TX level for students to study in their own time. He has never failed to make tax law easily understandable, and will point out common mistakes that students usually made while answering questions.

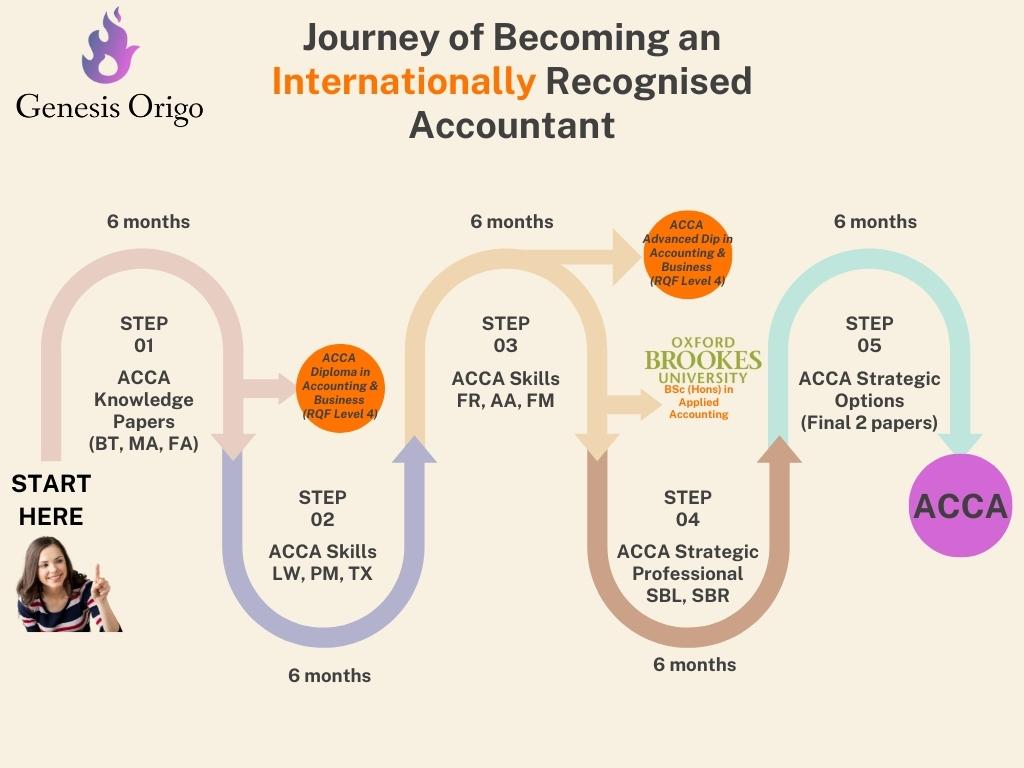

Looking at the Chart above, you can have all the flexibility you want to complete your ACCA studies. Recommended Study Plan for FAST & SHORT duration:

- Start with 3 papers at ACCA Knowledge papers (Papers BT, MA and FA). Complete it in 6 months duration. Also when you Pass the ACCA Foundations in Professionalism ethics module (no exam, no classes to attend) – you will be awarded an ACCA Diploma in Accounting & Business (RQF Level 4).

- Proceed with the next 3 papers at ACCA in ACCA Skills. There are 6 papers in the Skills level. You can take them in any sequence or combination (so long the exam date does not clash). We recommend you to take in the chronological order. However, you may also take the papers that are most relevant to your work place. For instance, we have students who started with Law, Taxation and Financial Reporting.

- Completing the 6 Skills papers in 12 months duration.

- Upon completion of ACCA Skills papers and ACCA Online Ethics and Professional Skills Module (no exam, no classes to attend) – you will be awarded an ACCA Advanced Diploma in Accounting and Business.

- At this point, if you wish to, you may purse the Oxford Brookes Degree option – you need to complete a Research and Analysis Project & Skills Learning Statement (About 10,000 words in total). Upon passing, you will be awarded with an BSc (Hons) in Applied Accounting by Oxford Brookes University, UK,

- There is no time limit being imposed for ACCA Knowledge and Skills level.

- You may now commence the ACCA Strategic Level Papers. There are 2 strategic professional papers, namely Strategic Business Leader (a 4-hour case study based exam paper) and Strategic Business Reporting to pass. This requires another 6 months duration.

- Finally, you have to complete 2 more strategic option papers – choose from Advanced Taxation, Advanced Financial Management, Advanced Audit & Assurance or Advanced Performance Management.

- You may choose to start with Strategic Option papers ahead of the Strategic Professional papers.

- There is a 7-year time limit on the Strategic Level papers that you have passed.

Is Professional Qualification Tough?

Quick Glimpse of What Our Satisfied Students Said