UPDATE Dec 2022: This Budget was announced pre-election by the former Finance Minister. However, following the formation of the Unity Government headed by our 10th PM, Dato’ Seri Anwar Ibrahim whom is also the present Finance Minister – this budget will not be tabled in the parliament. Instead there will be a new budget to be proposed in February 2023. [click – News Reported Here]

The Minister of Finance announced the national budget for year 2023 on 7-October-2022. Many Malaysians are often attracted to the budget announcement as these contain proposals that could impact them financially.

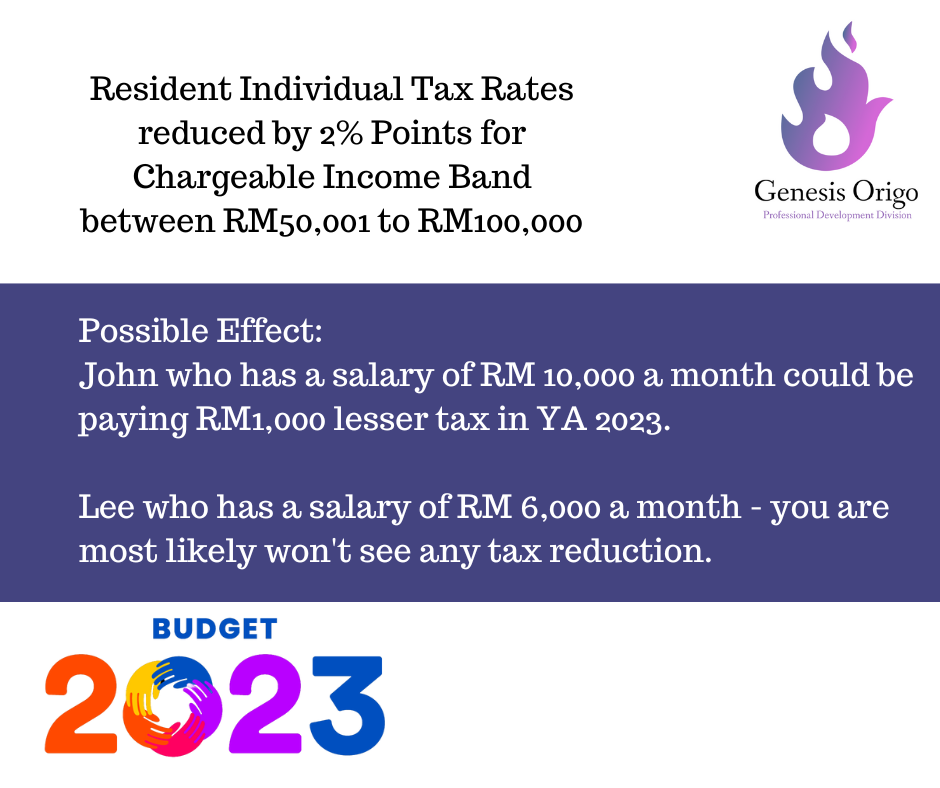

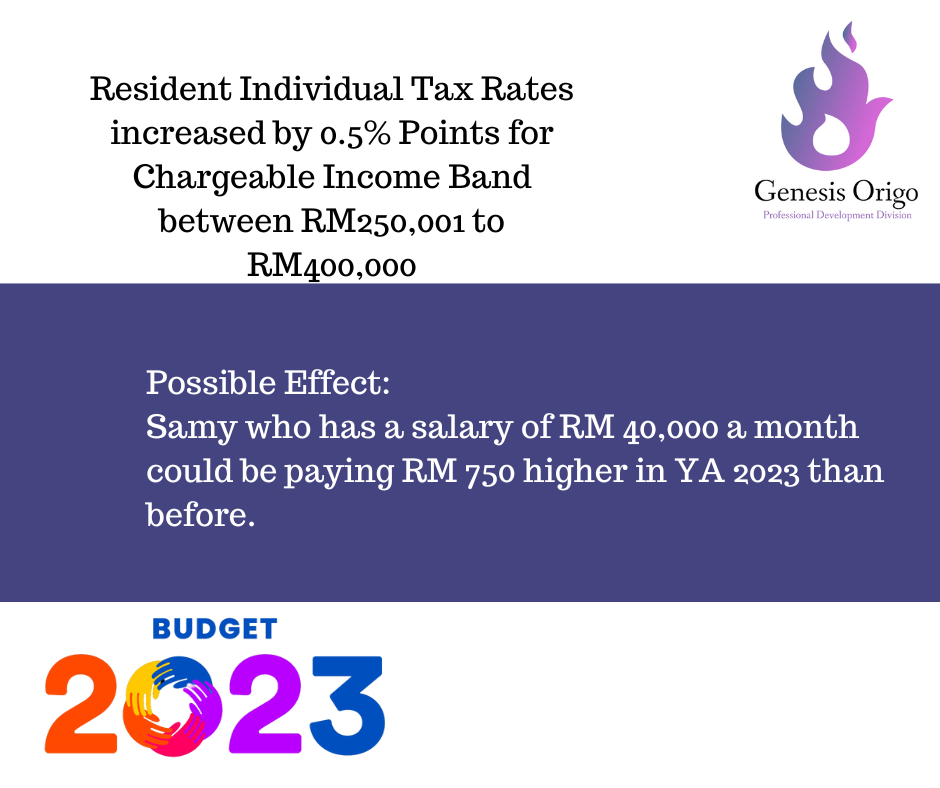

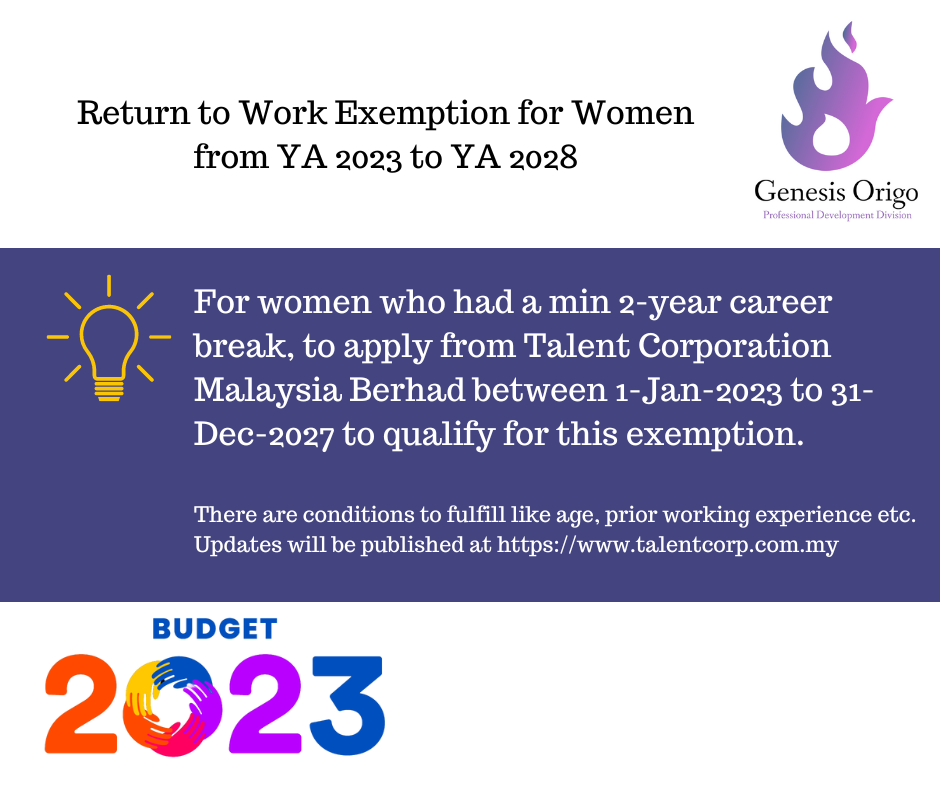

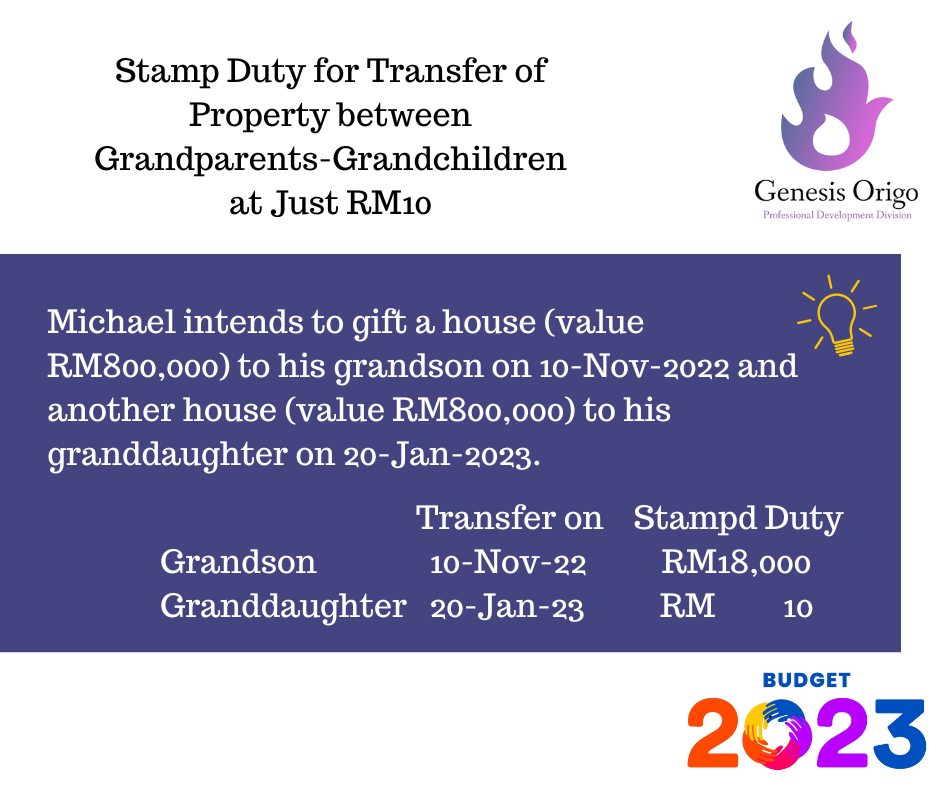

Many Malaysians will hear good news like various financial assistance to be distributed to eligible groups. Others will pay attention to tax proposals and wonder how these tax changes to come will be relevant to them.

Tax changes relevant to Individual and SMEs

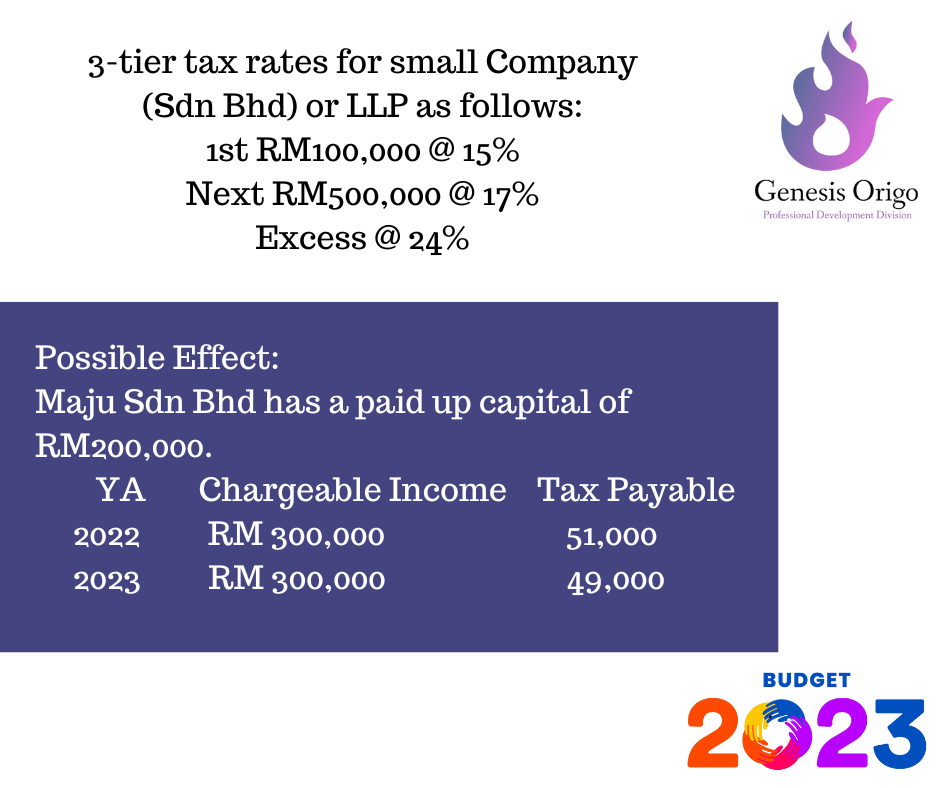

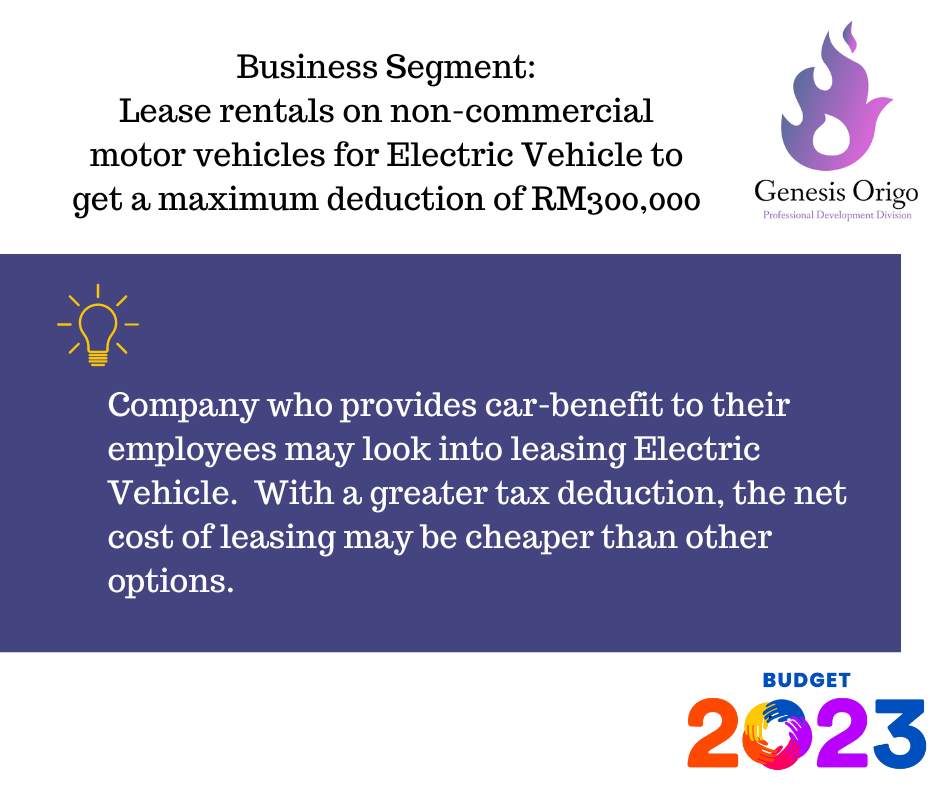

Not all tax proposals are relevant to individuals and small enterprises (usually referring to the Sdn Bhd and Limited Liability Partnership that has paid up capital of not exceeding RM2.5m). If you belong to this category, we would like to summarise the most relevant tax proposals to you through our infographics below:

Wish to learn more about Taxation?

Genesis Origo offers both Practical Taxation training programmes for the public (HRDC claimable) or Taxation and Advanced Taxation subjects in the ACCA programme.

Contact us to find out how you attend these trainings to add value to your taxation skills in your business or workplace.