Your children are going to be Poor

Observations and Concerns

- The Disappearance of Cash: When was the last time you, or those around you, used physical cash? We are being systematically conditioned to embrace electronic money, leading to a new generation for whom money is nothing more than numbers on a screen. You re being numbed.

- A Tale of Two Budgets: Consider this scenario:

- Peter has a $5,000 salary deposited directly into his bank account. He spends $4,000 using his e-wallet, leaving a balance of $1,000.David earns a $3,000 salary, also deposited in his account. Utilizing his e-wallet and accessible credit, he spends $4,000, which plunges him into $1,000 of debt and potentially massive interest accruals.

The Hidden Dangers of Easy Credit

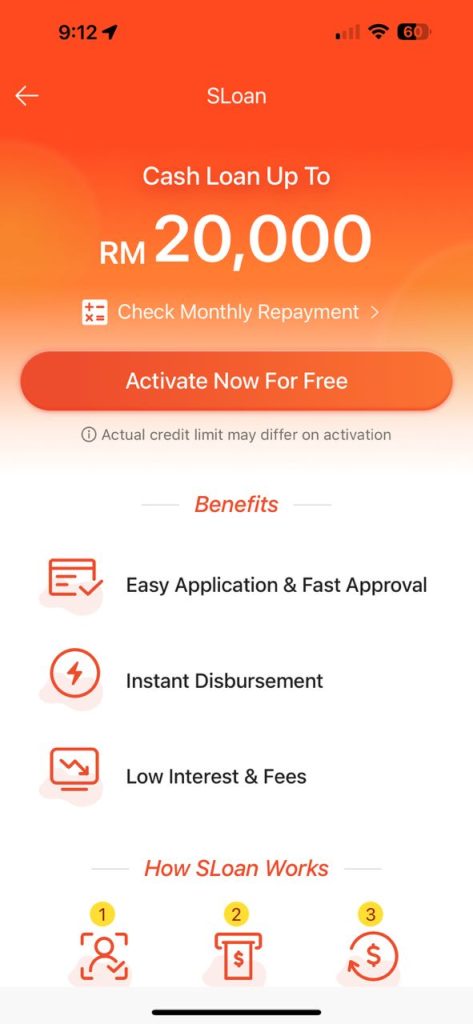

- The Lure of Instant Credit: Platforms like Shopee offer up to RM20,000 in credit at the touch of a button—with no documentation or signatures needed. An interest rate of “just 1.5% per month” sounds minimal but is deceptively expensive, capable of significantly depleting one’s earnings.

- The Illusion of Financial Freedom: Imagine having access to multiple lines of credit through Shopee, Lazada, TnG, and Boost, each offering RM20,000. This sums up to RM80,000 of credit to “enjoy life,” not to mention the various credit card features like cash advances and balance transfers. This virtual money creates an illusion that life’s quality is maintained, while in reality, it’s a financial trap.

The Brainwashing of the Next Generation

- Marketing Mantras

- These are cliches that successfully shaped the mindset of the next generations. (and succeeded)

- “Quality of life” Promises

- “Be free – You are in control, do what you want.”

- “YOLO – You only live once!”

- “Don’t miss out – You’ll regret it if you don’t do this today!”

- “Be smart – Manage your money wisely!”

- These are cliches that successfully shaped the mindset of the next generations. (and succeeded)

The Bleak Future

- Consequences of Debt:

- Property inheritance might soon be sold off to manage overwhelming debts.

- The appealing mantra that “renting is better” prevents true asset ownership, what more asset accumulation.

- Increasing corporate dominance as individuals continuously pay interest or rent – do not be in shock when overnight, rent rates go up by 30%, 50%. You have no say – pay or be homeless.

Personal Strategies

Credit is not bad if that you use it wisely and correctly – and with a lot of discipline.

- Responsible Credit Use: I leverage interest-free periods like the FREE 6-month and 3-month Shopee-Pay plans for business purchases, which significantly aids my working capital. These offers not only provide immediate financial relief but also strategic benefits in market competition.

- Advantages of Strategic Spending: Utilizing tools like 6-month interest-free balance transfers from credit cards wisely exemplifies effective cash flow management in business, not frivolous spending.

Make sure you do these for your children

- Teach them the discipline of spending.

- Distinguish between utility spending (e.g., buying Starbucks for business vs. pleasure).

- Teach them about assets that appreciate in value versus those that do not.

- Teach them about reality : you cannot use a financing at 1.5% interest per month for business because you never generate enough profit to pay them.

Financial Literacy is Your Gateway to Financial Freedom : Understanding the difference between assets and liabilities, and knowing how to manage spending and credit, is crucial. The knowledge gap between the financially literate and the illiterate is vast and can mean the difference between prosperity and poverty.